Investment

Investing should be easy – just buy low and sell high – but most of us have trouble following that simple advice. There are principles and strategies that may enable you to put together an investment portfolio that reflects your risk tolerance, time horizon, and goals. Understanding these principles and strategies can help you avoid some of the pitfalls that snare some investors.

Bull and Bear Go To Market

Learn about the difference between bulls and bears—markets, that is!

Have A Question About This Topic?

The Cycle of Investing

Understanding the cycle of investing may help you avoid easy pitfalls.

Investment Challenges of the Affluent Investor

Affluent investors face unique challenges when putting together an investment strategy. Make sure you keep these in mind.

Jane Bond: Scaling the Ladder

Agent Jane Bond is on the case, uncovering the mystery of bond laddering.

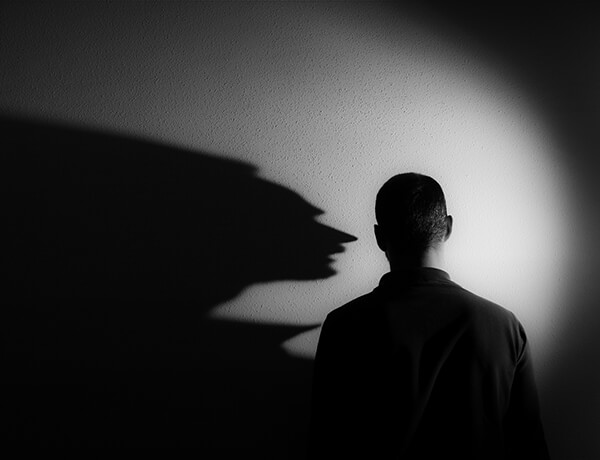

Don’t Be Your Own Worst Enemy

Emotional biases can adversely impact financial decision making. Here’s a few to be mindful of.

Estimating the Cost of College

This worksheet can help you estimate the costs of a four-year college program.

Alternative Investments - Going Mainstream

Alternative investments are going mainstream for accredited investors. It’s critical to sort through the complexity.

Buying a Home

A look at what you need to think about when buying a home.

Are You Ready for Your Portfolio to Make a Difference?

Learn about the rise of Impact Investing and how it may benefit you.

Mutual Funds vs. ETFs

Exchange-traded funds have some things in common with mutual funds, but there are differences, too.

View all articles

Contributing to an IRA?

Determine if you are eligible to contribute to a traditional or Roth IRA.

Impact of Taxes and Inflation

Estimate the potential impact taxes and inflation can have on the purchasing power of an investment.

Saving for College

This calculator can help you estimate how much you should be saving for college.

Taxable vs. Tax-Deferred Savings

Use this calculator to compare the future value of investments with different tax consequences.

What Is the Dividend Yield?

This calculator helps determine your pre-tax and after-tax dividend yield on a particular stock.

How Compound Interest Works

Use this calculator to better see the potential impact of compound interest on an asset.

View all calculators

Jane Bond: Infiltrating the Market

Agent Jane Bond is on the case, cracking the code on bonds.

Bursting the Bubble

Tulips were the first, but they won’t be the last. What forms a “bubble” and what causes them to burst?

What Smart Investors Know

Savvy investors take the time to separate emotion from fact.

The Business Cycle

How will you weather the ups and downs of the business cycle?

Bridging the Confidence Gap

In the world of finance, the effects of the "confidence gap" can be especially apparent.

Global and International Funds

Investors seeking world investments can choose between global and international funds. What's the difference?

View all videos

-

Articles

-

Calculators

-

Videos